2025 Ira Contribution Limits 2025 Catch Up. Read on to learn about the 2025 ira contribution limits. For individual retirement accounts, or iras—both roth and traditional types—2025 contributions will max out at $7,000, up.

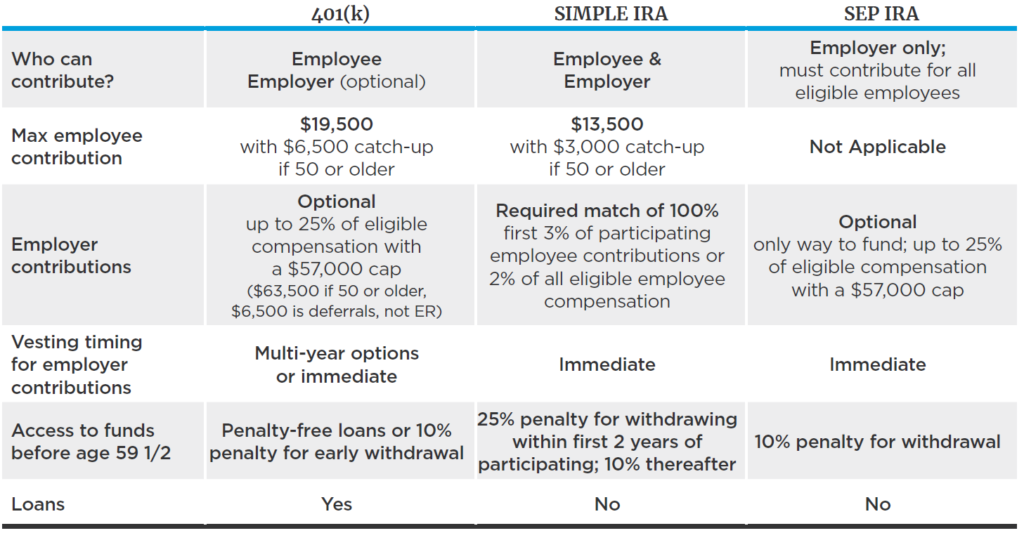

For individual retirement accounts, or iras—both roth and traditional types—2025 contributions will max out at $7,000, up. Workers who contribute to a 401(k), 403(b), most 457 plans and the federal government’s thrift savings plan can contribute up to $23,000 in 2025, a $500 increase.

Maximum Ira Contribution 2025 Catchup Edith Heloise, Read on to learn about the 2025 ira contribution limits.

Roth Ira Contribution Limits 2025 Catch Up Jess Romola, Understanding irs contribution limits is important, especially when your goal is to contribute the maximum to your account.

Simple Ira Contribution Limits 2025 Catch Up Kelsy Mellisa, The new retirement contribution and gift exemption limits for 2025 allow you.

401k Roth Ira Contribution Limits 2025 Clio Melody, The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

Irs Contribution Limit 2025 Maia Sophia, For individual retirement accounts, or iras—both roth and traditional types—2025 contributions will max out at $7,000, up.

Simple Ira Catch Up Contributions 2025 Xenia Colette, The annual contributions limit for traditional iras and roth iras was $7,000 for 2025, rising from $6,500 for 2025.

401k Limit 2025 Catch Up Rebe Alexine, The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

IRS Makes Historical Increase to 2025 HSA Contribution Limits First, The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2025) if you're younger than age 50.